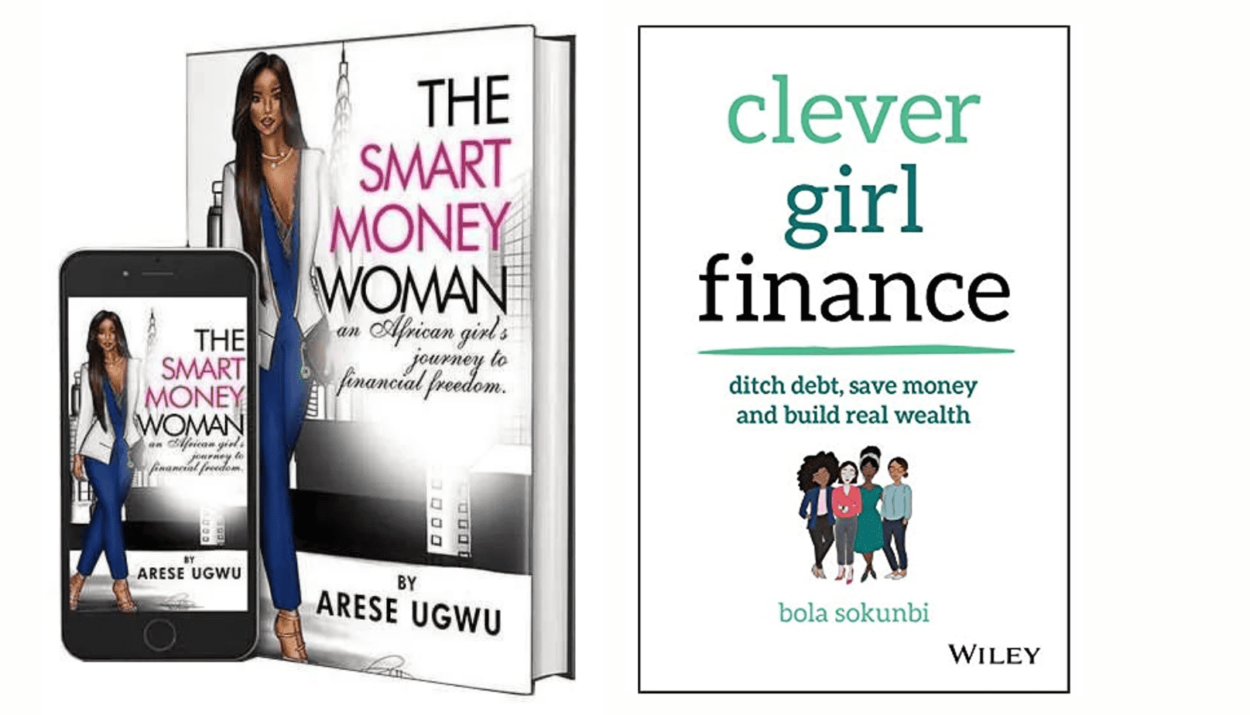

In this month dedicated to the woman in her entirety, at Strongmas Residence we are looking at the Book “The Smart Money Woman” written by Arese Ugwu and “Clever Girl Finance: Learn How Investing Works, Grow Your Money” written by Bola Sokunbi. With more women earning income in the country, it only makes sense for women to learn about financial planning.

According to Forbes, women earn 77 cents for every dollar earned by men globally. At the current rate, it is estimated that closing the global gender pay gap will take 257 years. Though the wage gap is gradually closing, women must step up their game in finance and investment to close it faster. This reading will provide you with financial growth tips. Don’t sleep on it!

The Smart Money Woman is a fictional story based around a young woman called Zuri who appeared to live an exorbitant life but in reality, was well on her way to endangering her financial security on the grounds of “Lagos living”.

While Clever Girl Finance: Learn How Investing Works, Grow Your Money is the go-to book for women who want to understand the fundamentals of personal investing. This book takes its readers on a straightforward-and-no-nonsense journey to understanding how investing works and what you should be doing to get ahead of the curve. How to use investing to build long-term wealth while earning a low salary. In addition, it highlights important pitfalls to avoid if you want to be a successful investor and how to save for retirement while investing in your future. Clever Girl Finance teaches readers the irreplaceable value of long-term financial gain through investing, as well as the distinction between making money and building wealth.

Now that we are done with the introductions, let’s get into business. How can these books help with your finance, especially women? What are the key lessons?

- Your path to financial success begins with the determination to make the necessary changes.

If you’ve ever tried to lose weight, get in shape, or improve your grades, you know there are no quick fixes. To achieve your financial goals, you’ll need to be willing to make some changes, just like you would at any other major life transition. You must allow yourself to dream and believe that your dreams can come true. The key to regaining control of your finances is to make peace with your biggest mental impediment: past financial mistakes. Fixating on these is what prevents many of us from progressing.

When you realize that the past is no longer relevant, you will no longer need to judge or blame yourself for what has already occurred, and you will be able to focus on the future. Just as with committing to exercise, you can buy all the fancy equipment in the world, but it won’t help you build those muscles if your heart isn’t in it.

The next step is to learn from your mistakes and begin changing your attitude toward money.

Picking up that pen and paper again and doing some serious reflection is a good strategy for identifying those lessons. Make a list of all the financial missteps you’ve made in the past, no matter how big or small. Then, write on the lessons learnt from each experience and what improvement steps you are willing to take for a sustainable future.

This will be your plan of action. For example, if you used to impulsively shop and never got around to saving, you can start saving a little per week or take advantage of some investment options at your bank. Even if it’s a small amount, consistency of action will put you on the right track and help you believe that a different path is possible.

- Track Your Expenses

Most people have no idea where their money goes. What percentage of your income do you spend on food? Transportation? Clothes? Just as it is important to track revenue and costs in any successful business, it is also important to track expenses in our personal lives.

We must learn to budget our money wisely and allocate our resources to reflect the lifestyles we want and can sustain over the long term. Understanding where the money is going at the beginning is the first step in solving any problem. Stop coming up with justifications, and start taking responsibility for your finances rather than letting them rule you.

- Build an emergency fund

We live in a deeply religious and superstitious society. So, even when we hear the terrible stories of people losing their jobs, or women losing the breadwinners of their households suddenly, then forced into relative pennilessness because they can no longer afford their rent and have to beg friends and family for money to pay the children’s school fees, we think ‘God forbid not me’. However, bad things do happen to good people from time to time. Instead of worrying without taking action, we should prepare for emergencies.

A wise woman recognizes that her emergency fund is the cornerstone of her financial path, so she continuously saves for it rather than waiting for unforeseen financial events.

- Develop a Sustainable Budget

One of the most common complaints about money is a lack of knowledge about how to save and budget. People associate the term “budget” with scarcity or a decline in social standing. As a result, “budget” becomes a word they despise. The reality is that a budget tells you how to allocate your resources and should reflect what you value.

Whether you earn ten thousand naira or ten million naira per month, your resources are limited, and consumption tends to rise with income, so it’s critical to have a spending plan that takes this into account.

In conclusion, we have highlighted key take ways from both books:

- Pay up your debt: Debts are not bad. However, one needs to ensure that it is paid off quickly. Thus is one of the first steps to saving money. Make a plan to pay off your debt as quickly as possible.

- Always save 20% of your income: No matter how difficult it is to save, no matter how many financial responsibilities you have, you must make it a point to save 20% of your income. Reduce your spending and increase your savings.

- Begin with a small emergency fund and then start saving for long-term goals.

- Build real wealth: Investing is the best way to build wealth. Start with a simple investment plan and then add to it as you learn more about investing.

- Increase your earning potential: You should strive for multiple sources of income. Knowing what you want out of life helps you to set goals for yourself. Invest aggressively as well; there are investment opportunities that are guaranteed to maximize one’s earnings.

- Use caution when lending.

- Have a solid support system in place.

- Have a professional mentor or guide: There are people who study business, investments, stock, finance, and risk management. Make people like this your guide. Attending management meetings and entrepreneurship meetings aids connections too. When you require assistance, always seek it.

- Do not live above your means or income: Zuri, the lady at the center of the story had an apartment on the Island where she pays millions yearly for rent alone, she wines and dines with friends in the most expensive restaurant, and wears only designers. She buys asoebi of different prices yet earns 600,000 naira monthly. There was no way she could avoid debts.

Don’t be like Zuri ensure you cut out unnecessary spending.

Check out other blog post

Check out our Instagram page